Plantation

Overweight

Sector Outlook

- Palm oil production continues to growth, albeit slower pace

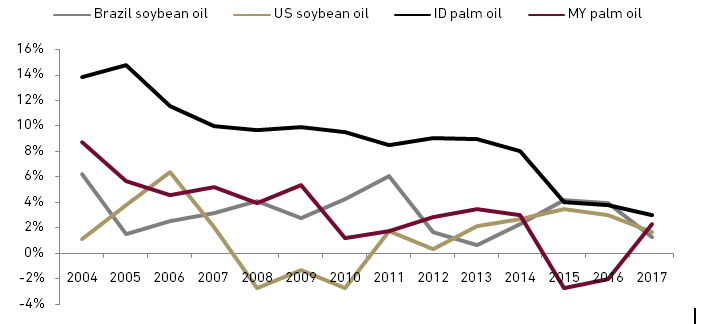

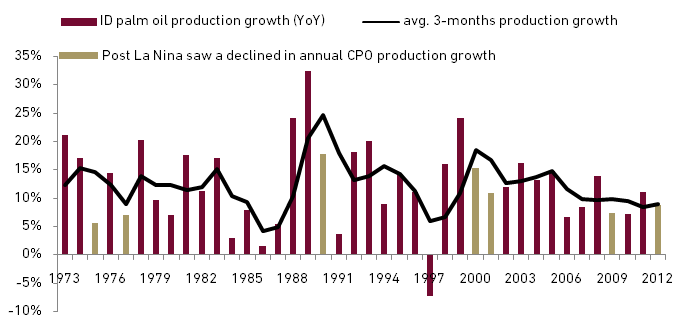

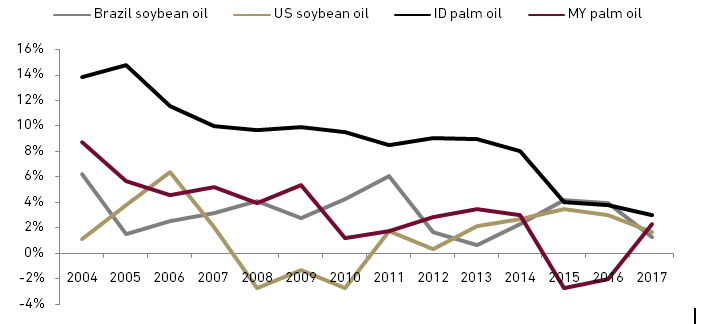

Palm oil remains the most traded vegetable oil in the world with only three countries to supply 75% of total world production, i.e. Indonesia, Malaysia and Argentina. The palm oil plantations in Indonesia has faced a long standing environmental and social issue and due to moratorium imposed by the Government since 2011, the annual growth of Indonesian palm oil output experiencing a downward trend (see Exhibit 1). It is expected that supply from the second most traded vegetable oil, soybean oil, is also on declined hence paved ways for vegetable oil price hike in 2018.

Exhibit 86: Major vegetable oil 3 years average production growth

Source : USDA

Due to limited new estates, majority of planters now shift their focus from plantation expansion to producing better yields. In the long run we should see considerable yield gaps between efficient planter and the less efficient ones.

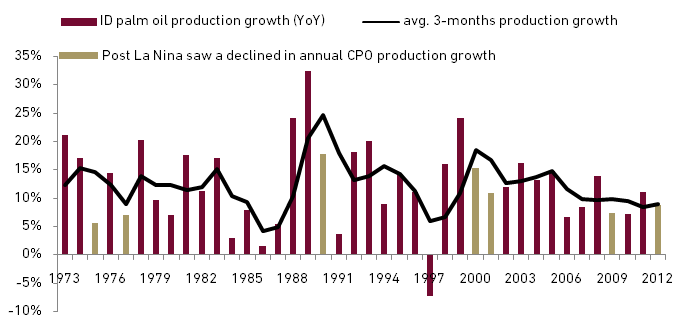

- Potentially the warmest La Nina in 2018

According to the National Oceanic and Atmospheric Administration (NOAA), there is a 65-75% chance of La Nina happening in 2018 and it is not only going to affect the Pacific Ocean at a surface-level, but also cool deeper waters in the ocean. For the Pacific region countries, La Nina will cause less-than average rate of precipitation. However, the La Nina is predicted to be relatively weak and is most likely to interrupt soybean harvest in North and Central America than palm oil output from Indonesia and Malaysia.

There had been 7 times strong category La Nina reported in the last 50 years and we see on Exhibit 2, the Indonesian CPO production post La Nina drop by average 10% YoY. Less evidence occurred in the event of moderate to weak category La Nina therefore we are optimistic for upward trend in production growth will continue throughout 2018.

Exhibit 87: Strong La Nina and Indonesia’s CPO production yearly growth

Source : NOAA, Oil World

Due to weak nature of La Nina, there is a chance that 2018 might be the warmest La Nina year on record. Global warming plays a vital role in muting the effects of La Nina in 2018. However we do not rule out the risk factor and if ever stronger event occurred we will revise our forecast for 2018 CPO price of RM2,700/ton.

- Expect CPO price to average atUSD640/ton in 2018

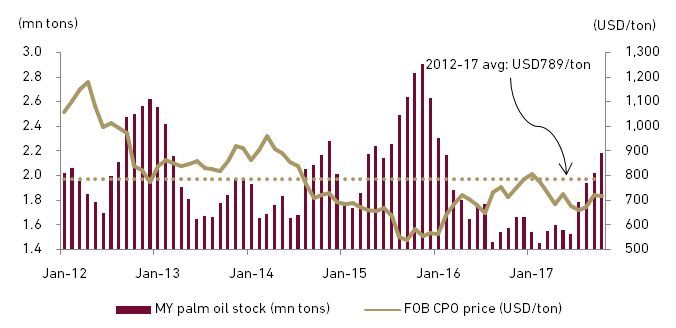

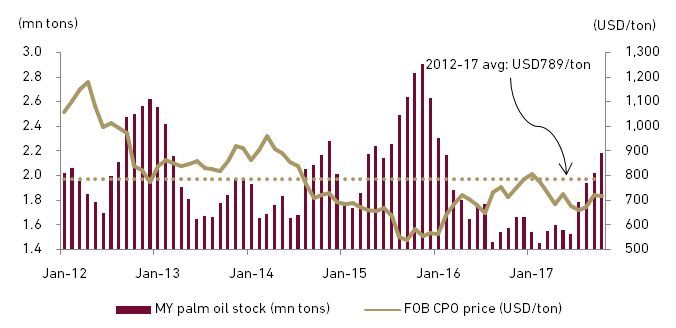

A look at the level of Malaysian CPO monthly closing stocks in the last few months of 2017 there is an imminent threat of inventory escalation looming over beginning of 2018. At the end of September 2017, the inventory rose to 2.02 mn tons, a 31% YoY level. As evidence on Exhibit 2 below, there is a strong negative correlation between CPO price and inventory level. We expect moderate CPO global price of USD 640/ton (RM2,700/ton) in 2018 which is lower than the 5 year average of USD789/ton.

Exhibit 88: Malaysia’s palm oil inventory vs. CPO global price

Source: MPOB, Oil World

Indonesia’s inventory level is also somewhat similar to the Malaysian counterpart however the condition is totally understandable given that second half of the year is the peak of harvesting seasons.

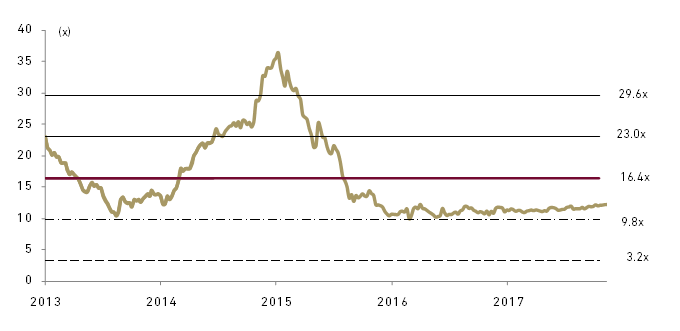

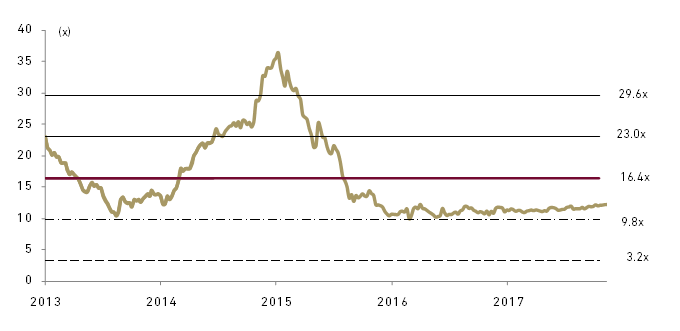

We expect CPO production growth of indo planters at less than 10% in 2018 given the high base of 2017 production and limited new mature estates. Nevertheless given the successful cost efficiency implemented we should see margins improvement in our top picks. Plantation sector is now trading at forward PER of 12.3x, slightly above 1-stdev mean of 9.8x. We derived our TP for plantation company are mostly based on average PER, which we deem achievable. We took note that plantations are prone to extreme weather that affects productivity and will greatly alter our forecasts.

Exhibit 89: Plantation sector* forward PER band

Source: Bloomberg and Ciptadana . * AALI, LSIP, SIMP, SGRO and TBLA,

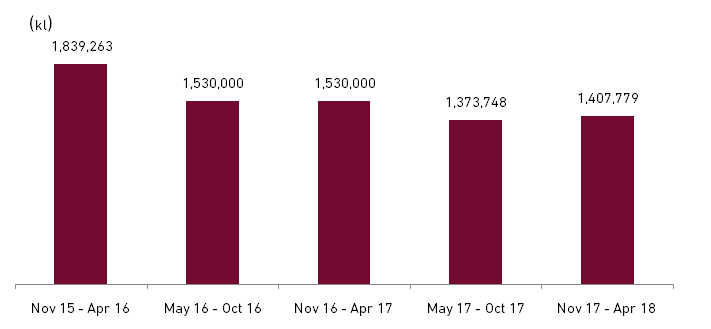

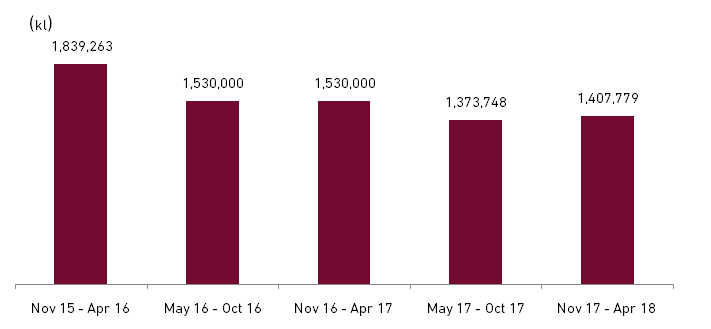

- Biodiesel mandates add support for demand increase

The use of palm oil has been increasing and currently 4.9% of total palm oil output is utilized for alternative fuel or biodiesel. Demand for biodiesel is strongly driven by national utilization mandates plus subsidies. Global biodiesel production is expected to inflate supported by expansion in transport fuel and rising share of diesel in transport fuel. Company under our universe that strongly correlated with the increase of national biodiesel output is TBLA which recently being appointed to supply almost 48,674 kl to Pertamina and AKR Corporindo for Nov 17 – Apr 18 period.

Exhibit 90: Indonesia’s biodiesel distribution volume

Source: Ministry of Energy and Mineral Resources

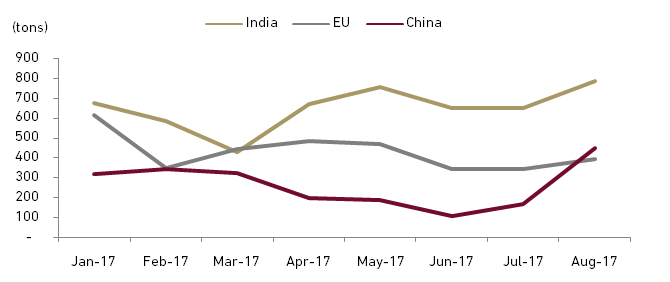

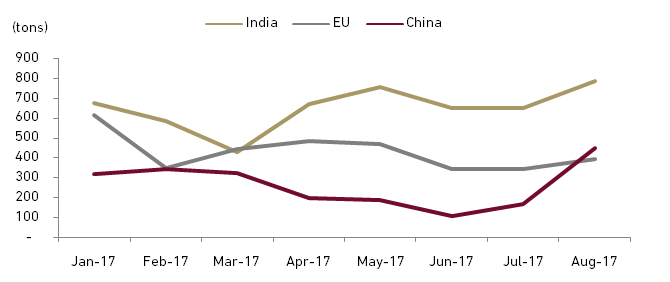

- Markets for Indonesian palm oil exports

India remains the largest market for Indonesian palm oil (44% as of August 17) hence Indonesia is susceptible to changes on India palm oil import duties. On August 2017, India doubled the import levy for CPO to 15% to support domestic farmers and refiners which are unfortunate for Indonesian palm oil exporter.

EU has been using palm oil primarily for biodiesel mix and demand from the region has been relatively flat as palm oil infamously recognized as environmentally unfriendly product. Fortunately increase on China demand help unburden the negative impacts of the aforementioned condition. Other than the three top importers, markets for Indonesian palm oil include Middle East countries and Africa with the number projected to grow annually.

Exhibit 91: Indonesia’s palm oil export destination (tons)

Source : GAPKI

We believe the current market prices did not fully represent the fundamental value of most of plantation companies. We prefer LSIP and AALI for their healthy balance sheets and premium age profiles which we believe will sustain softer expansion. We also like TBLA due to its correlation with biodiesel supply and lucrative sugar industry.

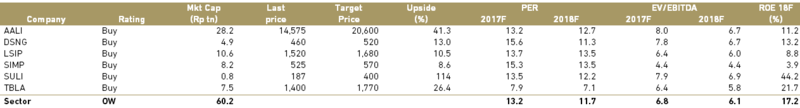

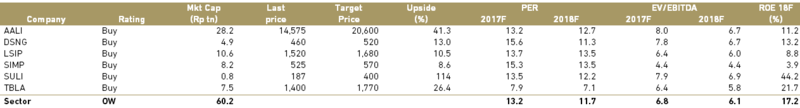

Exhibit 92: Plantation stock rating and valuation