Economic Outlook

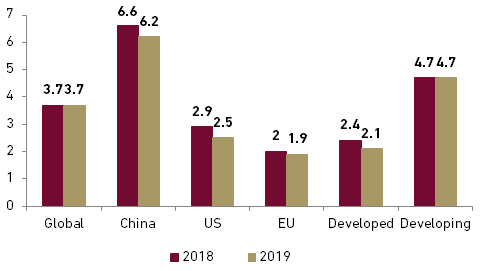

Global economic: pressure to emerging market may ease

High volatility became the main theme of 2018 macroeconomic environment. There are 3 major events triggering volatility: shifting FFR hike expectation, US – China trade war and emerging market countries currency crises (esp. Turkish Lira, Argentine Peso, etc). In 2019, we predicted volatility will be lower, enabling bull sentiment to take over after full year of bearish trend in 2018. However, risks still remain from possibility of more than 50 bps FFR hike, US – China trade war effect on their and global growth, potential new trade war between US – Japan and potential debt crisis in Turkey.

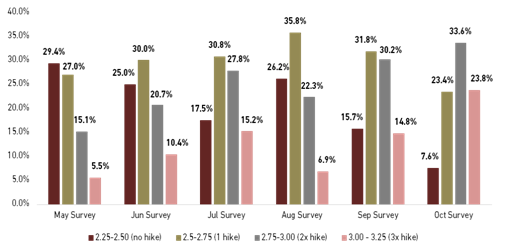

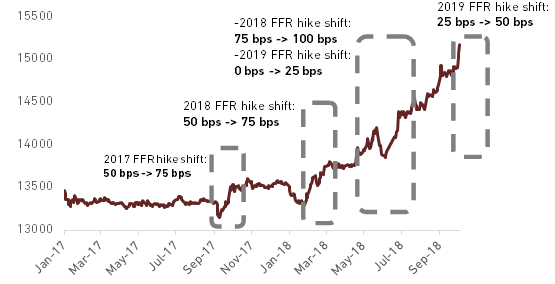

- 50 bps FFR hike in 2019 has priced in, 75 bps not yet

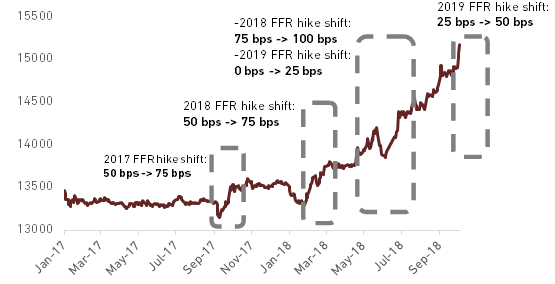

In 1H18, bearish sentiment had started since there were FFR hike expectation shift. In the beginning of this year, we shifted our expectation to 100 bps (4 times) FFR hike and were confirmed by Fed’s projection plot in June’s meeting. At end of 2017, most of economist surveyed by Bloomberg was still dovish, predicting 50 bps (2 times) FFR hikes in 2018. However, the forecast shifted to 75 bps (3 times) hikes in the end of January and shifted again to 100 bps (4 times) in April. The first shift (January – February) made USD/Rupiah depreciate from around Rp13,400 to Rp13,700 while the second shift (April) made Rupiah depreciate from around Rp 13,700 to Rp 13,900. Currently, Bloomberg consensus has priced in with us and Fed’s dot pot at 100 bps hike in 2018

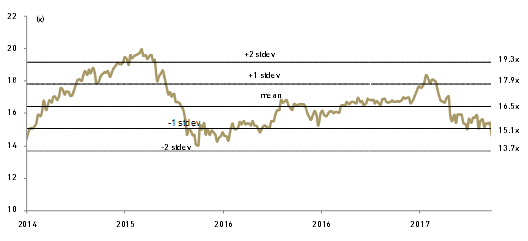

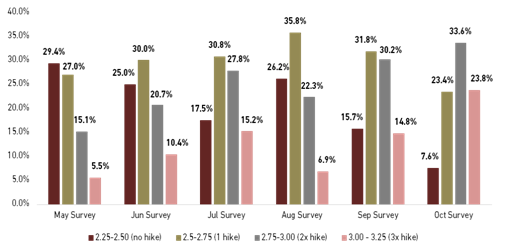

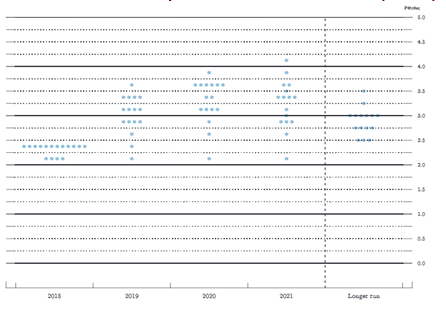

For 2019, we expect another 50 bps (2 times) FFR hike. Market seemed to price in 50 bps FFR hike since end of September 2018 (see exhibit 2) which make the 10 yr UST yield reached more than 3%. There is still a risk that FOMC will raise FFR by 75 bps (3 times) as their September projection still incorporate 3 hikes to 3.00% - 3.25%, slightly above 3% neutral rate. However, we see that US-China trade war effect may change employment trend in 2019 and prevent Fed to raise rate beyond neutral rate. If FFR is only raised by 50 bps next year, then current market expectation has priced in the hikes. If FFR raised more than 50 bps, we expect another expectation shift in 1Q19.

Exhibit 1: Bloomberg Economist Survey Estimate of 2019 FFR Hike

Source: Bloomberg

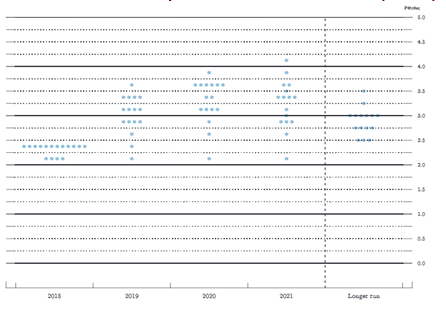

Exhibit 2: FOMC Participants View on Future Monetary Policy

Source: The Fed

- Trade war peak has passed but beware of its effect to growth

Trade war tension between US and China escalated significantly after they imposed tariff to each other products. As of October, US has sanctioned USD 250 bn of China’s goods with 10% - 25% tariff while China replied with imposing 25% tariff to USD110 bn of US goods. There is USD267 bn of China export products to US that not given tariff and there is a chance for Trump administration to enlarge trade war with Japan. However, we see that after November parliamentary election, the movement of Trump administration will be more limited as Democrats is predicted to take over the House.

Some risks though still need our further attention, such as:

- Potential Crisis in Italy, Turkey and some other emerging crisis

Political and debt turmoil had been major risk in Italy, 3rd biggest country in EU. As political condition became unstable due to popular anti EU in the election, Italy also faced problems with its high debt. Any crisis emerge from this country will significantly affect EU. Moreover, we also view potential debt crisis from Turkey as its Lira depreciated more than 40% in 2018. Most of Turkey’s debt is denominated outside Lira, making the debt is very vulnerable with the currency crisis. Other emerging market also had potential to crisis due to Fed’s policy normalization and domestic circumstances like Argentine, Venezuela and South Africa

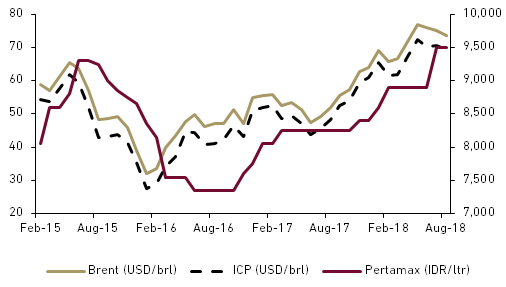

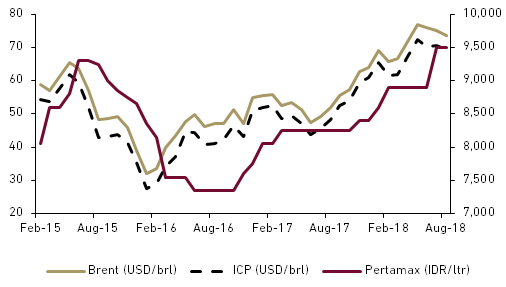

- Surge of oil price

High commodity prices are not always good for Indonesia’s economy, especially for oil price as Indonesia is a net importer of oil. Currently, Brent oil price already breaks above USD 80/barrel level as the result of OPEC production cut, increasing global demand and US sanction to Iran. If both OPEC and US do not increase the output, more than USD 90/barrel will not be impossible to be reached. Rising oil price will give another pressure to Indonesia’s CAD and Rupiah.

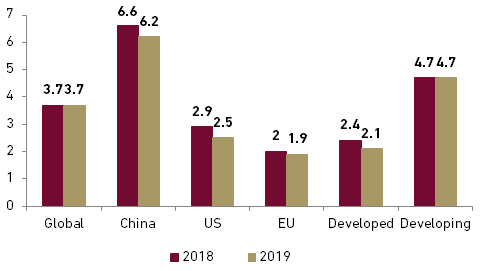

Exhibit 3: Global Economic Growth Forecast

Source: IMF

Exhibit 4: Brent Oil, ICP and Pertamax Price

Source: Bloomberg

CAD to slightly lower but remains high

Contrary to 2017 condition, trade balance experienced significant deficit (USD -4.1 bn YTD as of Aug -18) and even make current account deficit (CAD) was at 3.04% or above 3% safe limit in 2Q18. Better GDP and domestic demand made import growth jumped 24.52% YoY, reaching USD 124.2 bn as of September 2018. Higher oil price in 2018 (2018 avg: USD 72.7/barrel (as of Sept) vs 2017 avg: USD 54.8/barrel) gave another pressure to trade performance as Indonesia has became net oil importer since the beginning of 21st century. Export growth was actually not that disappointing as it had 10.39% YoY growth, boosted by higher coal and oil price. However, it could not still compensate jump in import growth. Moreover, Indonesia’s export reliance to commodities as main source of growth made limit its expansion to movement in commodities price, especially coal and CPO.

- Awaiting government’s program to limit import’s result

Starting September, government initiate some policies to reduce Indonesia’s import burden: B20 to improve utilization of CPO and reduce oil import, increasing income tax for several imported goods and delaying some of infrastructure projects to hold capital import goods. Although we are not sure increasing income tax for several imported goods will be significant to reduce import, we believe implementing B20 policy and halting some of infrastructure projects will give better outcomes. Furthermore, we view that Rupiah depreciation itself that will help to reduce import next year. We expect real import to grow 7.4% YoY from 10.5% in 2018F.

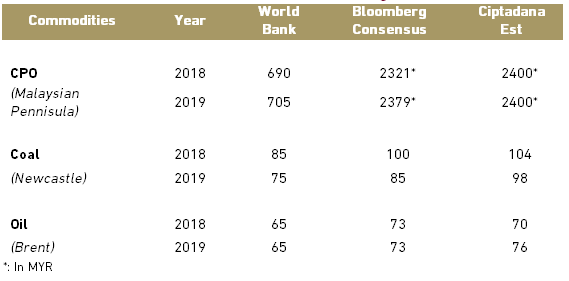

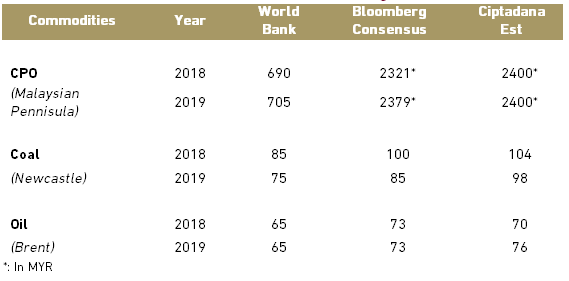

- Limited boost from commodities price

We do not expect both coal and CPO price to become the main driver of export growth in 2019. Asia-Pacific coal benchmark Newcastle prices is expected to average USD98/ton in 2019, slightly lower from USD104/ton this year average. We also do not see any significant pick up on CPO price as our analyst expect Malaysian peninsular price to remain stable at MYR 2,400/ton. Real export growth will slightly decrease to 6.8% YoY in 2019F, down from 2018F at 7.5% YoY

- Trade deficit lower but CAD to remain high at 2.5% of GDP

Considering our previous assumptions, we expect trade balance to remain in deficit territory but with lower magnitude. Service trade balance may have lower deficit in 2019 as tourism performance keep improving. Assuming no significant changes from both primary income and secondary income figures, we expect CAD at 2.5% of GDP next year, slightly lower than 2018F at 2.8% of GDP.

Exhibit 5: Commodities Price Forecast (Annual Average)

Source: WB, Bloomberg, Ciptadana Estimates

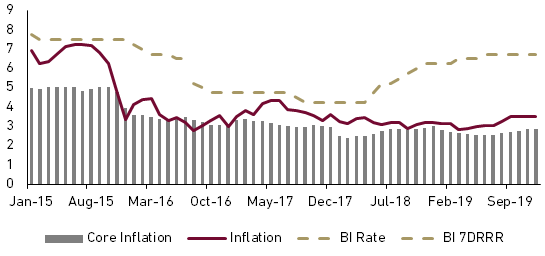

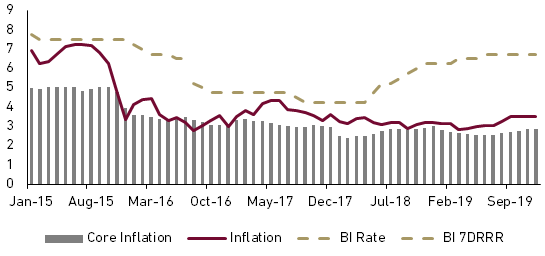

Inflation to remain stable at 3.5% despite potential fuel price hike

Inflation in 2018 remained low, even reaching 2.88% YoY in September 2018 and we expect YE 2018 inflation at 3.2% YoY. Thanks to less change in administered price and still manageable food price, Indonesia can keep its inflation low despite higher GDP growth. Although we expect subsidized fuel price hike in 2019, we remain confidence that 2019 inflation will still be manageable. Government will all out to maintain inflation, especially for food sector, in order to secure its position in upcoming election. Moreover, one of main theme from the opposition team is about relatively expensive food price for middle lower segment. High rice import in 2018 should help government secure inflation in 2019. Moreover, we see that higher interest rate may affect lower core inflation next year, in line with lower 2019F GDP growth.

- Fuel price can be raised in 2019

Government’ promise to maintain subsidized fuel price may end in 2019, especially after election period. We see that government try to hold price until next year for maintaining stability entering election period. Next year should be the correct time for subsidized fuel (Gasoline premium and Solar) price hike due to higher oil price. Current subsidized fuel price (Premium: Rp 6,500; Solar: Rp 5,500) was determined when Brent oil price was around 50/barrel (average 2019F: USD 76/barrel). Other fuel series had followed global oil price increase, like Pertalite (4.0%) and Pertamax (13.0%). We expect Rp 500/litre increase for both subsidized price (Premium: 7.6%; Solar: 9.7%) to make Pertamina’s balance sheet healthier.

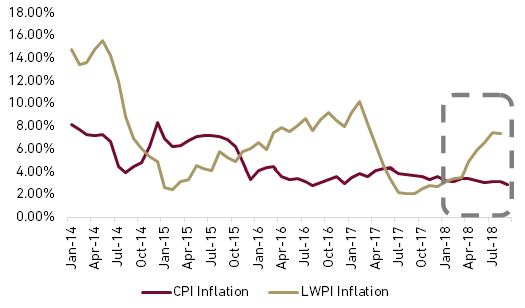

- Limited impact of Rupiah depreciation

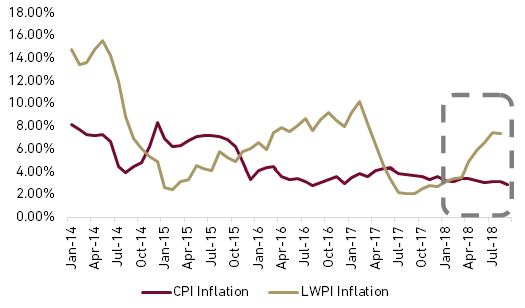

Rupiah depreciation is seen to have limited impact to core inflation. Unstable domestic demand recovery make most manufacture will only pass less significant amount of input cost to consumers. In 2013 and 2015, higher inflation was tend to be driven by subsidized fuel price hike as the inflation was already higher when Rupiah started to depreciate. Exhibit 7 denoted retailers’ preference to lower their margin as the higher wholesale inflation is not fully translated to higher consumer inflation. This situation makes us expect core inflation to be lower at 2.8% YoY, lower than our 2018F at 3.1% YoY. All in all, we expect inflation to remain at 3.5% YoY in 2019 despite fuel price hike.

Exhibit 6: YoY Inflation and policy rate

Source: CEIC, BI, Ciptadana Estimation

Exhibit 7: CPI Inflation and LWPI Inflation

Source: CEIC

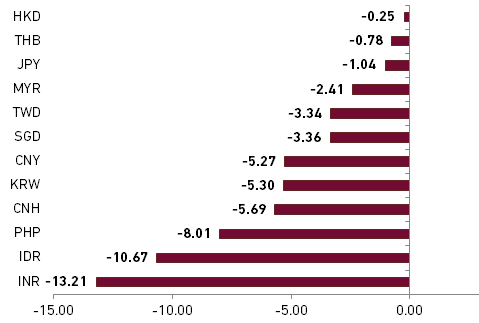

Rupiah pressure from CAD, expect 50 bps rate hike in our base case

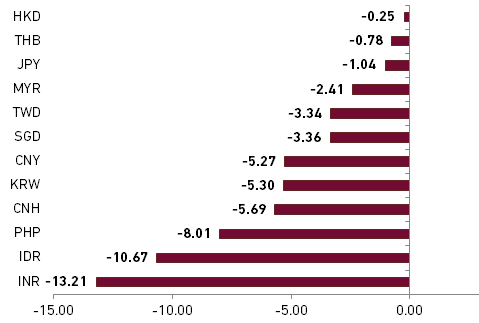

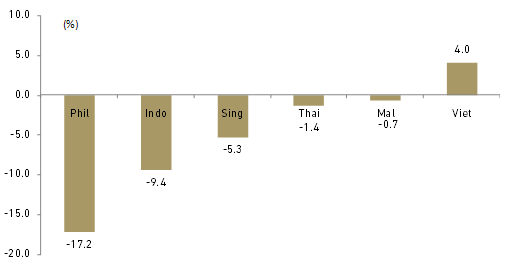

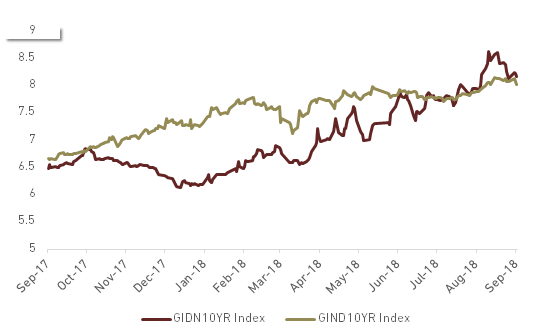

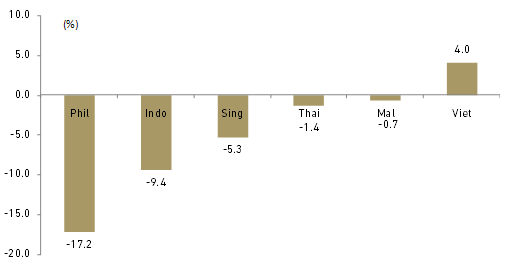

Combination of global pressure and widening CAD led to significant pressure to Rupiah, making it depreciated around 10% YTD to more than Rp15,000/USD in October. As market has priced in for 50bps rate hike in 2019, US treasury yield moves upward reaching 3.2% and bring capital back to US as USD index reached 96. Exhibit 9 showed how shifting FFR hike expectation affect Rupiah depreciation in 2017 – 2018. As Indonesia had higher CAD than region and also high proportion of foreign ownership in bonds and equity market, Rupiah became one of most severe victim in 2018 currency rout for Asia region (look at exhibit 8).

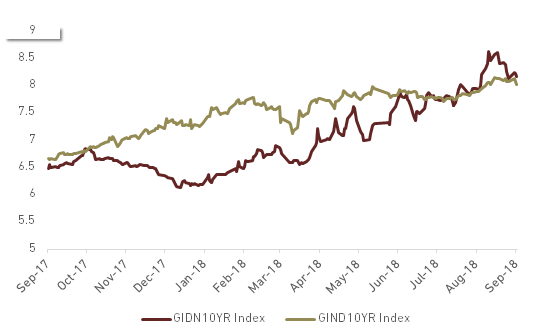

Bank Indonesia has raised rate for by 150bps so far to 5.75% to help Rupiah. However, our model denotes insignificant effect of rate hike to muffle Rupiah depreciation, especially in short term. Rate hike may push bond yield higher, making Indonesia’s yield higher than India (see exhibit 10) and more attractive for foreign investors despite more severe currency rout In India than Indonesia. It succeeds to maintain Indonesia’s bonds on net foreign buy territory as of September 2018 but it failed to bring Rupiah appreciate. Our model revealed that CAD, USD index, UST 10 year yield and Indonesia 5 yr CDS had more significant impact to Rupiah than BI 7-day reverse repo rate. Focussing on reducing CAD will give more significant impact for Rupiah amidst heightened global volatility than just a rate hike.

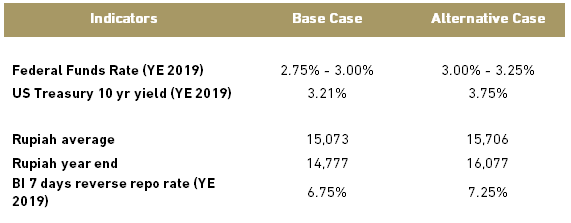

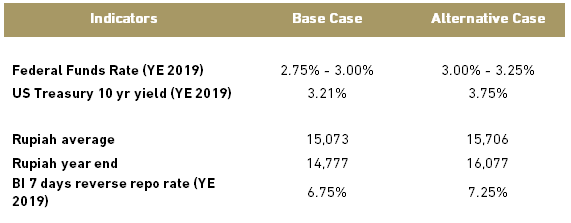

In 2019, we prepared 2 scenarios for Rupiah and rate expectation. The main difference between these two scenarios are the FFR expectation where the base case we only expect 50 bps hike with no further FFR hike in following years and second scenario where we follow FOMC guidance’s of 75 bps hike in 2019 and 25 bps hike in 2020. We incorporate potential FFR hike in 2020 because investors should try to price in Fed’s policy in 2020 by the end of 2019. For your information, our Rupiah and rate forecast does not incorporate higher tension of trade war and potential crisis in Italy, Turkey and other emerging markets. Higher oil price is included our scenario as it will affect CAD in our model.

Exhibit 8: Asia Currencies returns YTD as of Oct 5

Source: Bloomberg

Exhibit 9: Rupiah and FFR Hike Expectation Shift

Source: Bloomberg

- Base case: USD/Rupiah at Rp 15,073 in 2019F average, YE rate at 6.75%

In our base case, we expect FFR will only be raised by 50 bps to 2.75% - 3.00% or lower than current FOMC projection. We believe that the effect of US-China of trade war is still not seen to employment segment. When unemployment rate and wage growth change from their current trend, Fed may consider cutting their FFR hike to only 50 bps or the high end of neutral rate (2.75% - 3.00%).

In this scenario, we expect Rupiah will have Rp 15,073 average in 2019. Rupiah will find pressure in the beginning of 2019 as investors try to weigh Fed’s projection of either 50 -75 bps FFR hike for 2019 in March meeting. Market pressure from FFR hike expectation will ease if Fed address only 50 bps FFR hike. Furthermore, slightly lower CAD as we expected in previous part enabling Rupiah to strengthen beyond Rp 15,000 level to reach Rp 14,777 in YE 2019. According this case, Bank Indonesia will raise rate by only 50 bps to match Fed’s pace in raising FFR.

- Alternative case: Rupiah at Rp15,706 in 2019F average, YE rate at 7.25%

Using the alternative scenario means higher pressure for Rupiah next year even though it will be still lower than 2018’s. Using FOMC meeting September’s guidance, FFR will be raised by 75 bps in 2019 and 25 bps in 2020. Market, who have priced in for 50 bps FFR hike since October 2018, will try to adjust for 50 bps more hike. We expect the first adjustment will happen in March and the second one in September. UST will have an uptrend to reach 3.65% in YE 2019 while we expect USD index to be slightly below 100. Indonesia’s 5 yr CDS will be around 126 in 2019 average, meaning the risk for Rupiah still high.

In this scenario, we expect USD/Rupiah to average Rp15,706 in 2019 with weaker YE closing at Rp16,077. Bank Indonesia will need to raise rate by 100 bps following the Rupiah movement.

Exhibit 10: Indonesia and India 10 year Bonds yield

Source: Bloomberg

Exhibit 11: Base and Alternative Case for Rupiah and Policy Rate in 2019

Source: Ciptadana estimates

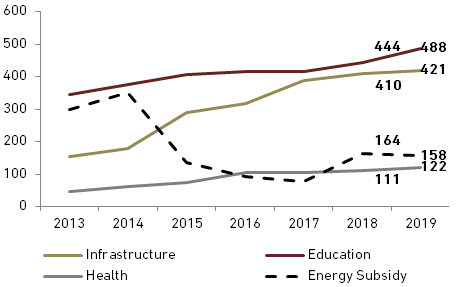

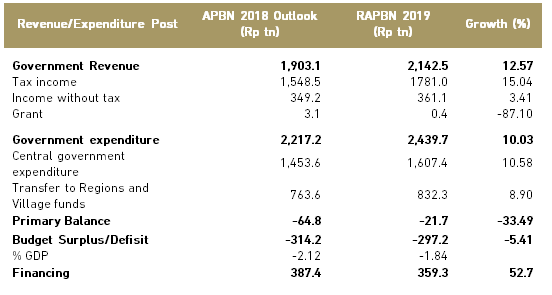

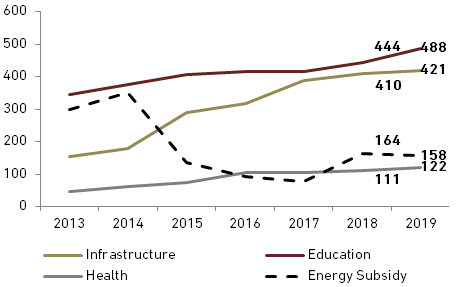

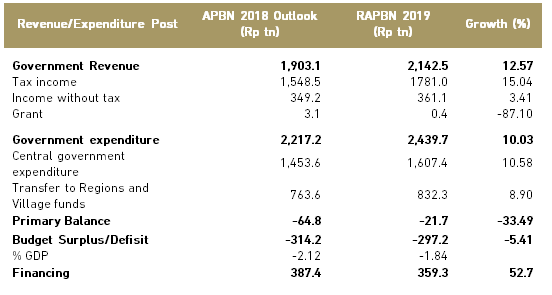

Still populist fiscal to compensate Rupiah depreciation and higher rate

Government expenditure is set to increase by 10.0% from state budget 2018 realization to Rp 2,439 tn, with more allocation to social spending. Social assistance spending is set to grow 14.4% YoY to Rp 185.99 tn, much higher than 2018 growth (3.0%) in 2019 state budget draft. This allocation follows similar pattern with ex-president Susilo Bambang Yudhoyono (SBY), who also increased his social assistance budget by 27.5% when he campaigned during 2009 presidential election. Government also increased the allocation of regional transfer by 9.0% to Rp 832.3 tn, with village funds experienced the highest growth (21.7%) to Rp 73 tn. From 2018 experience, government program through village funds (especially cash for work) is seen effective to improve middle lower purchasing power. Meanwhile, government still put positive growth to infrastructure spending at 2.5% To Rp 421 tn even though the growth rate was lower than 2018 budget’s at 5.9% YoY.

- Confidence on government revenue post and lower deficit

Tax revenue improve in 2018, as of August 2018, tax revenue had reached Rp 799.42 tn or grew 16.5% YoY, reaching 56.14% of target. This figure is better than August 2018 performance when tax revenue only reached 53.4% of target. We expect 2018 tax revenue can reach Rp 1,352.8 tn (17.5% YoY) or 95% of target, favoured by automatic exchange of information (AEoI) agreement with Singapore that enabling Indonesia’s tax office to exchange Indonesian’s account data in Singapore. Combined with another boost in non-tax revenue due to higher oil price, we expect government can meet its revenue target of Rp 1,894,7 tn in FY 2018 with budget deficit around 2.1% of GDP.

Similar condition is expected to continue in 2019. AEoI can be the booster of tax revenue in 2019, making tax revenue can meet 95% - 100% of target next year. Non tax revenue is predicted not to exceed target as high as this year as government already set ICP assumption at USD 70/barrel, making tax revenue performance more vital than this year to meet revenue target. Government deficit should be around 1.8% of GDP in 2019 and any potential shortfall of government revenue will be managed by reducing energy subsidy and increasing fuel price as the election period only last in 1H19.

Exhibit 12: Government expenditure budget 2018 by sectors

Source: MoF

Exhibit 13: Government’s budget for 2018

Source: MoF

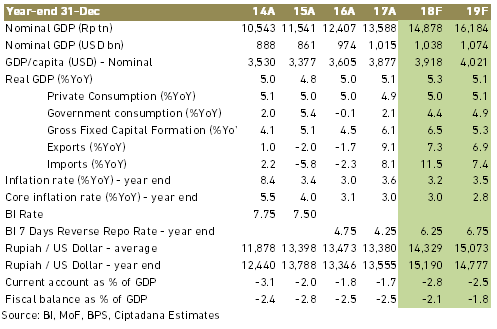

Rupiah and higher rate to threaten GDP growth but populist fiscal will defend

Economic growth experienced modest pick up to around 5.16% YoY in 1H18 and we still expect 2018 growth to reach 5.26% in FY 2018. Investment still became the main driver of growth as it grew 6.89% YoY in 1H18. Consumption also denoted gradual recovery in 1H18 with 5.05% YoY growth after posting below 5% growth in 2017. However, the story must be different in 2019 as Rupiah depreciation and higher interest rate should drag down the growth, especially investment, to around 5.1%.

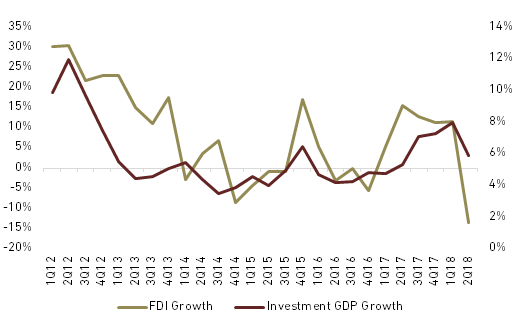

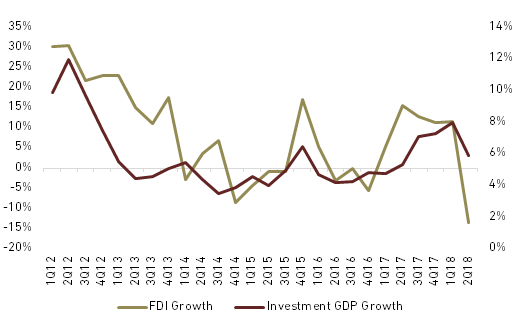

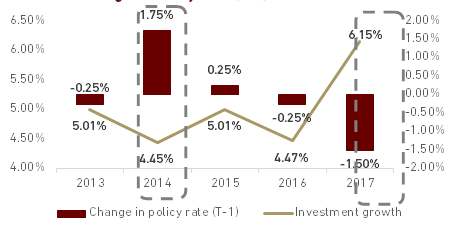

- Negative sentiment to investment

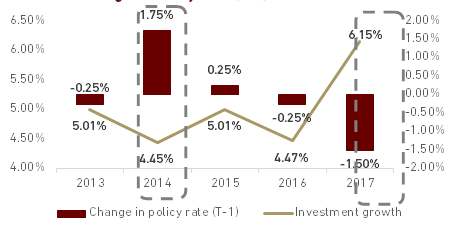

In 3Q17 – 1Q18, investment experienced significant growth above 7% as favored by lower interest rate, higher public infrastructure spending and stable Rupiah. However, the story should be different in starting 2H18 until 2019 as Rupiah depreciation and higher interest rate to challenge the resilience of investment. Even in 2Q18, foreign direct investment (FDI) already had double digit negative growth at -13.4% YoY, significantly lower than 1Q18 that still had 10.9% YoY growth, bringing investment growth in GDP to only 5.87% YoY. From exhibit 14, we learn that FDI growth in USD have strong correlation with investment growth in GDP. Continuous negative growth in FDI (in USD term) may restrain future investment growth and overall GDP. Furthermore, we believe that rate hike effect to investment growth will be more significant next year due to higher rate. Credit rate usually need 6-12 months (which means early 2019 in current case) to adapt higher policy rate. In 2014, investment growth experienced slow down due to significant higher rate in 2013 while 150 bps rate cut in 2016 give significant boost to 2017 investment growth (see exhibit 15).

Based on our view above, we predict investment growth in 2019 to be lower at 5.3% YoY from 6.5% in 2018.

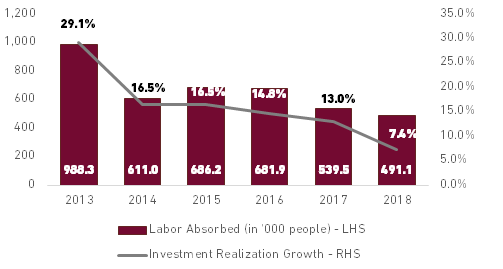

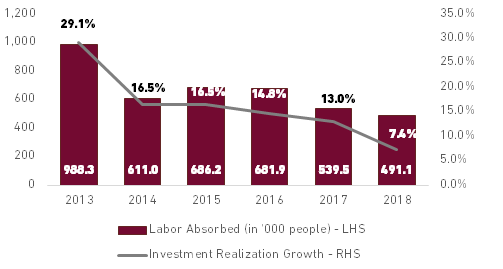

- Consumption to become the champion next year

2Q18 became the major sign of awakening consumption growth as its growth reached 5.14% YoY after experiencing less than 5% growth since 4Q16. However, we do not think the higher purchasing power came from “organic growth” or better labor profile. According to investment board, labor absorption from investment in 1H18 was lower than 1H17. Although it is not reflected in higher unemployment rate, lower absorption reduce the chance to get full time job, as full time worker proportion decrease in February labor data. We view higher government social spending that played a significant role in raising consumption growth in 2Q18. In 1H18, realization of social assistance grew 74.8% YoY to Rp 45.1 tn in order to assist government social program like Program keluarga Harapan and non cash food aid.

Exhibit 14: Gross Fixed Capital Formation and FDI Correlation

Source: BKPM, CEIC

Exhibit 15: Change in Policy rate (T-1) and Investment Growth in GDP

Source: CEIC

Entering 2019, consumption growth will still depend on government spending as investment growth is predicted to be lower and restrain labor absorption. Government higher spending on social assistance and campaign spending will enable consumption remains robust. In state budget 2019 draft, social spending is set to grow 14.4% YoY to Rp 185.99 tn, much higher than 2018 growth (3.0%) and 2017 growth (4.6%). Moreover, it also raised civil servant salary by 5%, the first raise since 2015. These push should increase people purchasing power temporarily in the election year. We see cigarettes companies will be most benefited from higher government and non – institutional consumption in 2019.

Despite we see better consumption environment in 2019, the view also comes with some risks. First, there is a possibility of subsidized fuel price hike after the presidential election which we have elaborated on inflation section. Second, if Rupiah depreciation continues and firm decide to fully pass it to consumer, it may affect inflation and make people purchasing power, especially middle upper segment, lower. Third, potential political instability, especially if the election process and result is not as expected, will make people hold their spending in the political year.

Given those conditions, we expect that consumption will continue its uptrend growth in 2019. We expect 5.0% consumption growth in 2018 and a mild increase to 5.1% in 2019.

Exhibit 16: Investment Realization Growth and Labour Absorbed

Source: BKPM

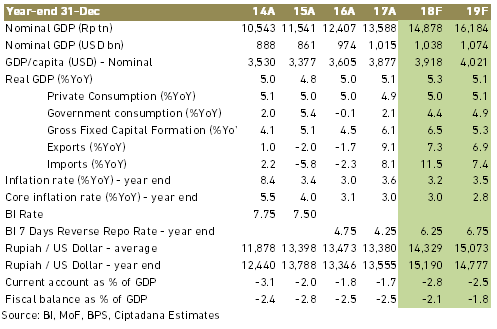

Exhibit 17: Indonesia’s Macroeconomic Projection

Source: BI, MoF, BPS, Ciptadana Estimates

Strategy

Politic and policies

- Political landscape to heat up ahead of 2019 national elections

The presidential election in Indonesia next year will see a rematch between President Joko Widodo (Jokowi) and retired general Prabowo Subianto. President Jokowi chosen Ma'ruf Amin, the head of Indonesian Ulema Council (MUI) as his running mate in next year's presidential race. Jokowi describes Amin as a wise religious figure and get support from all nine parties in his coalition, holding 60% of parliamentary vote. Meanwhile, Prabowo, chosen as his running mate Sandiaga Uno, a wealthy businessman who had been serving as deputy governor of Jakarta. In the 2014 presidential election, Jokowi and running mate Jusuf Kalla secured 53.1% of the vote, compared with 46.9% by Prabowo and Hatta Rajasa.

We believe by picking Ma’ruf, Jokowi attempts to win the hearts of Muslim voters and to pre-empt political attacks questioning his credentials as a Muslim leader. Jokowi has also learned from the fall of Jakarta’s former governor Basuki Tjahaja Purnama (Ahok). After the demonstrations by the Islamic community to influence the Jakarta governor election, Jokowi has had massive concerns about the expression of Muslim opinion in politics. The choice of Ma’ruf is to appeal to the traditional Muslim voters, who are represented by NU, and in general, Muslim voters in Indonesia are moderate. Most polls suggested Jokowi who are backed by nine political parties controlling 60% of the seats at Parliament would be favorite to defeat Prabowo at next year’s poll. Jokowi’s coalition parties are PDIP (109 seats), Golkar (91 seats), PKB (47 seats), PPP (39 seats), NasDem (35 seats), Hanura (16 seats). Meanwhile Prabowo’s coalition parties consist of Gerindra (73 seats), Democratic Party (61 seats), PKS (40 seats), PAN (40 seats).

In the latest Indonesian Survey Circle (LSI) poll, taken after the vice presidential nominations were announced on August 9, Jokowi still has a 52.2%-29.5% lead over Prabowo, though 18.8% are undecided. However we view that the result of 2019 election is still less predictable. Recall that in 2014 presidential race the gap can narrow fast. The results of the 2014 legislative election also revealed that more than 38% of all eligible voters in Indonesia can be classified as swing voters. We view that Prabowo camp may be wise not to hinge their campaign on attacking Widodo’s negatives, and should shift campaign on economic issues. The economic problems range from the sharp weakening of rupiah, the lower-than-expected GDP growth and higher government debt position. This leaves Jokowi with plenty of homework to do.

- Policy shift from reformist to populist, focused on winning

With national elections around the corner, Jokowi seems to be backtracking on his reform agenda with a string of populist measures. Jokowi plans to keep electricity tariffs and fuel prices unchanged over the next two years by hiking energy subsidies in draft state budget 2019. The government has imposed price controls too on staple goods such as fuel, power, rice and sugar which are the moves that will surely be welcomed by voters but may threaten investment climate.

The government has also allocated Rp381 tn for social welfare spending in the 2019 draft state budget. This implies annual increase of 32%, which is significant increase compared to a CAGR of 4.8% from Rp249.4 tn in 2015 to Rp287.7 in 2018’s projection. However, on the positive note , as government will more use a card-base system to prevent leakage and The Family Hope Program (PKH) will receive higher allocation. The PKH budget would be doubled to Rp34.4 tn from previously Rp17 tn in 2018. PKH program was expected to decrease the poverty rate at 8.5 to 9.3%. The government will also raise salary of civil servant by 5% on average in 2019 (no raise for this year).

Market recap

Selling pressure continues on the Indonesian bourses causing the benchmark JCI to drop by 9.43% Ytd to 5,757 (4 Oct).This market sell-off was due mainly to concerns about global sentiment, particularly the US Federal Reserve’s interest rates hikes and global trade war fear, which continues to put pressure on the rupiah. Rupiah fell to above Rp15,000 (10.7%) . The Indonesian rupiah is the currencies with twin deficits (current account deficit and fiscal deficit), in addition to the Philippine peso (weakened by 8.0% Ytd), which made investors more worried on hawkish Fed sentiment. The Indonesian stock market was the second underperformer market in South-East (SE) Asia after the Philippines of 17.3%.

Exhibit 18: South East Asia equity market performance

Source: Bloomberg

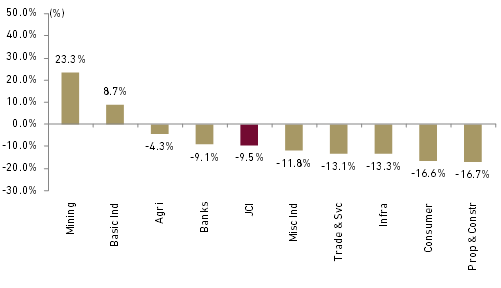

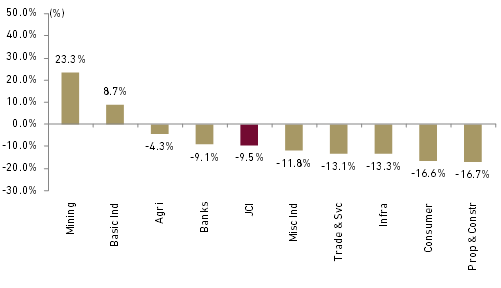

On sectoral indices, only mining and basic industry sectors booked positive return of 23.3% and 8.7% Ytd. Solid performance in mining stocks were led by gain in our coal analyst’s pick PTBA , BYAN and INCO. Basic industry strong performance was supported by strong gain in CPIN, INKP and TKIM. On the weak side, property (including contractors) have taken the biggest hit of all sectors, down 16.7% followed by heavy weight consumer sector of 16.6% , infra /utilities (incl. telco) of 13.3% and Miscellaneous industry (auto) of -11.8% that were the real culprits dragging down the index.

Exhibit 19: JCI sectoral indices performance

Source: Bloomberg

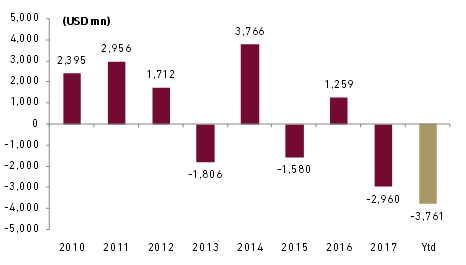

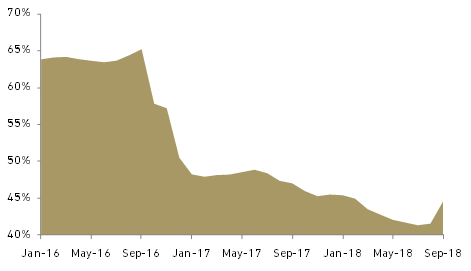

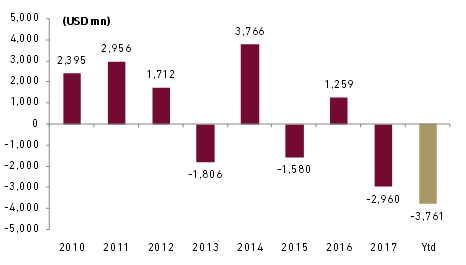

- Biggest annual foreign outflow in 2018

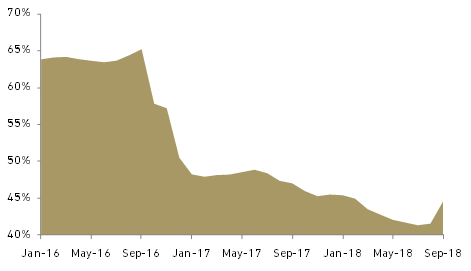

Foreign investors girded for the potential of further Fed interest-rate hikes to put a floor under the nation’s currency, which has hit its weakest against the dollar since 1998. Foreign investors have pulled out USD3.8 bn from equities market this year, set for the biggest annual outflow from Indonesia ever. Data from the Indonesian Central Custodian Depository ( KSEI) also shows foreign ownership in Indonesia equity has fallen steadily from 65% in Sep-16 to 41-42% in Jul-Aug 18, before picking up slightly this year to close to 45% in Sep-18.

Exhibit 20: Foreign net sell at Indonesia equity market

Source: Bloomberg

Exhibit 21: Foreigner ownership of Indonesian stock

Source: KSEI

Outlook for market in 2019

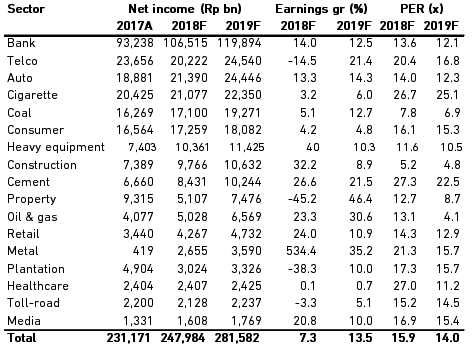

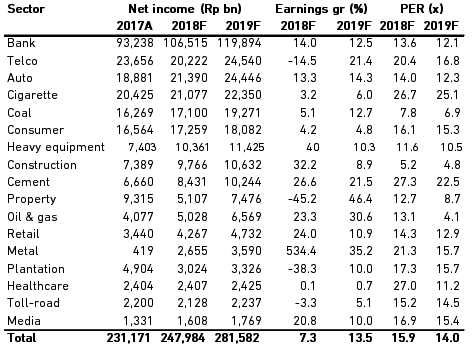

- Corporate earnings: 2019F universe EPS growth estimated at 13.5%

We expect 2019F market EPS (we use our universe EPS as proxy) to grow by 13.5% in 2019F (see table below). This will be boosted largely by the banking sector with net profit growing by 12.5% to Rp119.9 tn led by BBCA of 15.6%, BMRI of 11.4% and BBNI of 11.1%. Banking stocks earnings are expected to continue its double-digit growth from 14.2% in 2018F. This second contributor to aggregate earnings is Telco sector whose net profit seen growing by 21.4% to Rp24 tn. This is a recovery from 14.5% decline in 2018F earnings dragged by expected losses in Indosat. We only cover Astra in automotive sector and we also see it repeating its double-digit earnings growth from 2018F, which both yearly growth will be mainly driven by United Tractors. All of sectors are expected to book positive earnings growth in 2019 but we see some sectors posting negative earnings growth this year such as telco, property, plantation and toll-road.

Exhibit 22: Aggregate net profit forecast

Source: Ciptadana Sekuritas

- Election and better global sentiment to drive return, JCI target at 6,980

The Indonesian stock market seems nervous nearly seven months going into general election 2019. It is jostling weak emerging markets, rising rates, higher oil prices, slower earnings growth and relatively rich valuations. However, if past is anything to go by, Indonesian market has gained on three general elections that were held since 1998 reform era, namely 44.6% in 2004, 87.0% in 2009 (partly also due to low base effect of 2008 GFC causing JCI to drop 50.6%) and 22.3% in 2014. We believe the major reason why the market had been rising during the general elections were mostly expectation a political stability. Markets prefer a reform-oriented government under a strong leader. We also expect volatility of Indonesia equity market will ease in 2019 on better global sentiment owing to the following reasons: 1) trade war fear, which currently is terrifying investors, will gradually fizzle and is already priced-in 2) Fed will less aggressive in hiking rates and 3) Lower foreign ownership of Indonesian stocks as mentioned before which might lead to less net foreign selling.

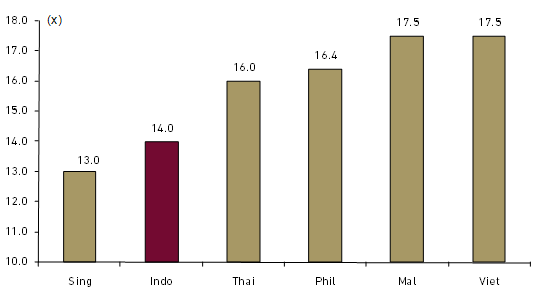

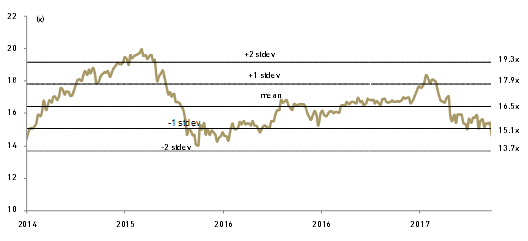

Therefore, we are positive on Indonesian equities going into 2019. We believe returns could be back-loaded as investors waiting for election results and trade war fear to ease. Applying market PER of 15.8x, which is based on -0.5stdev, and then multiple by forward market EPS of 442, we set year-end 2019 JCI target of 6,980. We believe, if corporate earnings move at a steady pace going into 2019 and reach the double-digit mark, fear about valuation should lessen. Therefore, we Overweight the Indonesian equity market as our JCI target implies 21% upside potential from current level of 5,756.

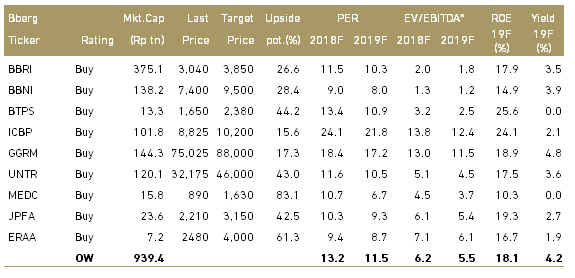

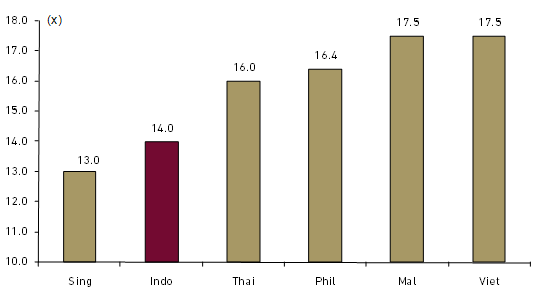

The Indonesia equity market is now trading at 2019F PER of 14.0x. This is much lower than 10-year average PE of 16.5x. The market PER has also come off from its peak of 19.9x in 2015. On regional comparison, the valuation is still interesting, the second cheapest after Singapore and more attractive than other SE Asia peers.

Exhibit 23: Indonesian stock market forward PER

Source: Bloomberg and Ciptadana Sekuritas

Exhibit 24: SE Asia equity market PER comparison

Source: Bloomberg and Ciptadana Sekuritas

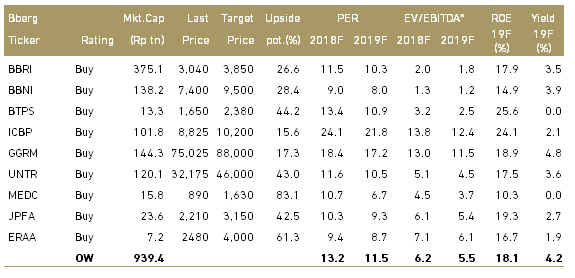

- Key themes and top picks for 2019

We have four themes for the market in 2019: i) banks that are expected to continue performing well during rising interest rate environment: BBRI, BBNI and BTPS (ii) beneficiary recovering household consumption on consumption-friendly policy ahead elections (GGRM and ICBP), iii) beneficiary of strong commodity prices and strong USD (UNTR and MEDC ) , iv) cheap valuation with attractive upside potential (JPFA and ERAA).

We believe BBRI to continue having strong loan growth from its subsidized micro and better upside from reduction of credit charge as they have became very conservative in the last two years. BBNI is also among the cheapest bank among the big four and underperformed the most in 2018, but we believe it will perform well under rising interest rates environment and deliver double digit earnings growth. We also continue to like BTPS for the non-big four banks on its double-digit NIM providing cushion against rising cost of fund.

We expect household spending to improve as the government has launched a number of fiscal stimulus program and more populist policy ahead of election. We believe cigarette producer (GGRM) and staple food producer (ICBP) will benefit from government increasing focus to lift low-income consumption. Given their revenues are in USD or USD-linked while we expect commodity prices to remain solid (coal is still seen above USD90/ton and oil to stay above USD78/bbl in 2019, respectively), we see these should benefit commodity plays such as UNTR and MEDC.

We also like poultry play JPFA as after series of culling program in previous years, limitation of quota on Grand Parent Stock (GPS) imports, and AGP (antibiotic growth promoter) ban eventually starting in early 2018 silver linings on selling prices have been appeared. We see government will keep their eyes on the sector and maintain its supply discipline in order to manage the current market equilibrium. Therefore, we view the price of DOC and broiler to remain resilient going forward.

We like mobile phones retail business industry too, due to its sensitiveness towards new product launch. There must be hype in Indonesia every time new product is coming and people will always want to be updated by having the latest series of mobile devices. ERAA is our top pick as it is trading an only 8.7x forward FY19F PER, 41% discount compare to its peers.

Exhibit 25: Our stock picks

*PBV for banks

Source: Bloomberg and Ciptadana estimates